The webinar presents an in-depth look at all the currently active Investment Opportunities offered by our company. It specifically addressed different investor preferences, focusing on both cash flow and equity growth with tax advantages.

For investors prioritizing cash flow, the webinar highlighted our Promissory Note Fund. This opportunity features real estate-backed debt, with a robust history of 15 years in operation. It boasts a track record of over $20,000,000 in lifetime distributions without any missed payments. The returns are attractive at 10% annualized, distributed monthly.

For those interested in equity growth and tax benefits, the webinar delved into two active development projects:

- The Emree in West Bend, WI: This project comprises 105 units of Class-A multifamily assets in a market with 98% occupancy, primarily serving major insurance, health, and defense companies. The targeted returns are impressive, with a 17.35% Targeted Internal Rate of Return (IRR) and 11.15% target cash on cash.

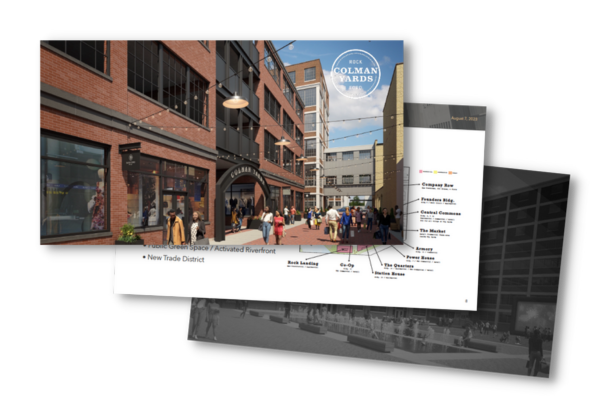

- Colman Yards in Rockford, IL: A larger development featuring over 900 units and more than 130,000 SF of commercial space. The project is in a market with 99.4% occupancy and has been designated as an Economic Development District. The returns are promising, with a 16.82% Target Net to Investor IRR. The development partner for this project is J. Jeffers & Co., known for a 49.72% IRR on 7 deals.

This webinar serves as a vital resource for investors looking to understand and engage with the current investment landscape as offered by our company.