Phase One

A) Founders Building / Apartments

- 181 Apartments / 2,700 SF Club Room

- 2,000 SF Roof Deck / 1,500 SF Co-working Space

- 160,000 SF total

B) New Parking Garage & Retail

- 336 Parking Spaces / 15,000 SF Retail

- 144,000 Total SF / New Construction

- 100% Financed via City Incentives

C) Central Commons / Apartments & Retail

- 34 apartments / 8,500 SF Gym / 7,400 SF Retail

- 56,000 Total SF

A catalytic, multi-phase, master planned Live Work Play community, creating new accessible housing, new jobs, new vibrancy in downtown Rockford, IL.

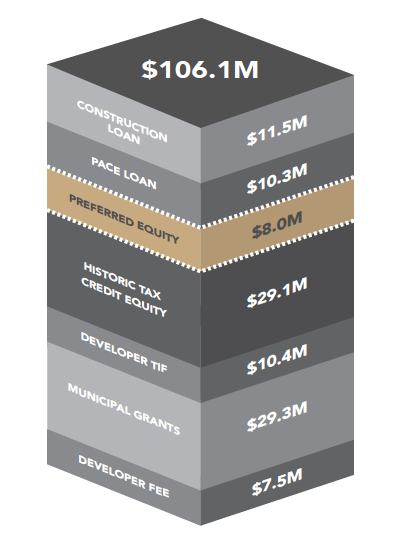

Investment

Highlights

Total Raise (Stage One): $8.0 million

City and Tax Credit Incentives: $68.74 million

Estimated Project IRR (4yr Hold): 19.27%

Estimated Investor IRR (4yr Hold): 16.82%

LP Equity Multiple (4yr Hold): 1.74x

Minimum Investment: $100,000

Sample Investment

- Initial Commitment: $100,000

- Cash-on-Cash

- Year 2: $5,491 (5.5%)

- Year 3: $18,965 (19.0%)

- Year 4: $149,546 (149.5%)

*The XIRR was calculated using quarterly distribution timing. This information was derived from J. Jeffers & Company. Please refer to the Private Placement Memorandum (“PPM”) for fully detailed investment terms, risk factors, and investor compliance requirements. This is not a full summary of all investment terms, risk factors, and investor compliance requirements.

What is the minimum investment?

$250,000, though investments between $100,000 and $250,000 will be considered by the managing member on a case-by-case basis.

What is the market demand for apartments in Rockford?

According to the market study done by Tracy Cross & Associates, the Rockford market has a demand base of 405 new apartments, which could double, based on the pent-up demand and undersupplied apartment market. Current vacancy sits at 0.6% with no proposed developments of more than 65 units, making competition extremely limited.

Why Rockford and this location?

Rockford is the 5th largest city in Illinois with higher-than-average concentration of engineering, manufacturing, R&D, and aerospace employment, with continued growth. The location is walking distance to the Downtown District, a block from the Rock River, and located on Main St for easy access to employers and shopping.

Who is the general contractor on the project?

ENC Construction & Development (“ENC”) is a contracting firm based in Illinois. The project team has also engaged an owner’s representative, Daccord, who has served as an owner’s rep on several projects that ENC has constructed. ENC has experience with projects of this size and scale. ENC has assigned team members that have prior experience with historic tax credit and adaptive reuse development.

What is the anticipated construction timeline for this project?

The project will break ground between September and October 2023 and be complete in May 2025.

What is the anticipated hold period?

We are targeting 4 years, but we will analyze the market to optimize the best return for our investors.

What is the deferred developer fee of $7.5m?

The deferred developer fee (“DDF”) is approximately 95% of available cash flow from the project during the tax credit recapture period.. The DDF is paid out to investors through distributions. Please reference the PPM for additional information on the DDF and how distributions will be paid.

What is the projected investor return and equity multiple?

Projected limited partner IRR is 16.82% with an equity multiple of 1.74x.

The Sponsor has prepared for Stage One of the Project the above projected returns for the Company. The forecasts are based on a variety of assumptions and estimates, not all of which may prove accurate. There can be no guarantee or assurance that the financial performance of the Project or the Company will match such forecasts.

Please reference page 22 of the PPM for additional information regarding the financial projections. An investment in the Company involves substantial risks, including those set forth in the Risk Factors section of the PPM.

What is included in this Investment/Development?

The Stage One historic rehabilitation plan includes:

- The Founders Building

- 181 apartments / 2,700 square foot club room

- 2,000 square foot roof deck / 1,500 square foot coworking space

- 160,000 total square feet

- New Parking Garage & Retail

- 336 parking spaces / 15,000 square feet of retail space

- 144,000 total square feet of new construction

- 100% financed by city incentives C/D) Central Commons

- 34 apartments / 8,500 square foot gym / 7,400 square feet of retail space

56,000 total square feet

Are there cash disbursements in Year 1 and 2?

The Company, Colman I Investor, LLC, does not expect to have cash available for distribution to Members until the completion and subsequent lease-up and stabilization of Stage One of the Project, which is expected to occur in the third year of the expected holding period. For additional discussion, see the section of the Memorandum titled “The Project.”

Each Member (including the Manager in its capacity as a Member) will be entitled to receive, when, as and if authorized by the Manager, cumulative distributions at the rate of 8.0% per annum of such Member’s aggregate Capital Contributions (the “Preferred Distributions”). Preferred Distributions payable to each Member will accrue and be cumulative from and including the Closing on which such Member was admitted to the Company as a Member and funded its Initial Capital Contribution and will be payable annually in arrears. Preferred Distributions will accrue whether or not the Company has earnings, whether or not there are assets legally available for the payment thereof and whether or not such distributions are authorized or declared by the Manager.

Please reference the PPM for additional information regarding distributions.

How is exit value and estimated payoff in Year 4 proceeds computed?

The Company intends to hold its ownership interests in the Stage One properties (i.e., Buildings 4, 5, and 9 of the Project along with the to-be-constructed attached parking structure) until such time as the Stage One properties can be refinanced with a U.S. Department of Housing and Urban Development (“HUD”) Section 223(F) or similar permanent debt placement, at the Sponsor’s discretion which is expected to result in a four-year investment horizon. The actual hold period will be subject to market conditions and as a result, the Sponsor may elect to refinance at a later time.

Upon the placement of permanent debt on the Stage One properties (a “Refinancing”), the Company will be dissolved and terminated, and all residual proceeds from such Refinancing will be distributed to the Members in accordance with the terms of the Colman I Investor, LLC agreement. See “Distributions–Priority” in the PPM.

Please reference the PPM, including Exhibit B for additional information regarding the exit and year four proceeds.

How is fair market value computed?

The Company intends to hold its ownership interests in the Stage One properties (i.e., Buildings 4, 5, and 9 of the Project along with the to-be-constructed attached parking structure) until such time as the Stage One properties can be refinanced with a U.S. Department of Housing and Urban Development (“HUD”) Section 223(F) or similar permanent debt placement, at the Sponsor’s discretion which is expected to result in a four-year investment horizon. The actual hold period will be subject to market conditions and as a result, the Sponsor may elect to refinance at a later time.

Upon the placement of permanent debt on the Stage One properties (a “Refinancing”), the Company will be dissolved and terminated, and all residual proceeds from such Refinancing will be distributed to the Members in accordance with the terms of the Colman I Investor, LLC agreement. See “Distributions–Priority” in the PPM.

Please reference the PPM, including Exhibit B for additional information regarding the exit and year four proceeds.

What is the estimated timeline for construction?

Construction is anticipated to take 20 months.

What is the estimated time for projected lease-up?

We are projecting stabilized occupancy by January 2026.

What is the nature of existing developments in the area?

The existing developments are primarily LITEC (low-income housing). Local market-rate developers like Urban Equities focus on much smaller projects of 20-30 units, but these are fully leased upon building completion, providing positive rental comparatives.

What is the role of the municipality in this project?

The city of Rockford has labeled this project as a high priority providing significant support. Please reference the City Redevelopment Agreement and Incentives in the PPM for additional details on the city’s financial support for the project.

How have environmental concerns been addressed?

Upon acquiring the vacated campus in 2002, the City of Rockford began an environmental assessment and cleanup process with the U.S. Environmental Protection Agency to position the site for redevelopment. That process is currently in its final phase. During the city’s ownership, the complex was successfully placed on the National Register of Historic Places, enabling eligibility for HTCs. The Barber-Colman Company Historic District was established in 2006.

In 2007, the State of Illinois created the RERZ program to stimulate the development of environmentally challenged properties near rivers THVROUGH the use of tax incentives. This program was established for Rockford and four other Illinois municipalities to create and retain jobs and stimulate business and industrial retention and growth. The emphasis for these RERZ projects is returning environmentally challenged sites to productive use. The Rockford RERZ – which includes the former Barber-Colman site – is a 30-year old program.

How is the financing structured?

The Sponsor expects to obtain financing for Property Owner consisting of approximately $21.8 million of secured debt and approximately $10.4 million in a Tax Increment Financing (“TIF”) loan. In addition, the Project will utilize federal and state of Illinois Historic Tax Credit (“HTC”) equity of approximately $29.7 million, with respect to which the Company will obtain a Historic Tax Credit (“HTC”) Bridge Loan for approximately $25.2 million that will be available for funding upon the closing of construction financing. In addition, the City of Rockford will be providing approximately $29.3 million in grant and loan funding for the Project. The successful completion of the redevelopment of the Project as discussed herein is contingent upon the financing discussed below being obtained when anticipated and on satisfactory terms.

Please reference page 17 of the PPM for a full discussion of the Project Financing.

What kind of tenants are you expecting for the apartment and retail?

We’re targeting a variety of tenants to occupy the multi-family units, ranging from young professionals to retirees seeking simple, amenity-rich living, and single adults to families, depending on the unit (bedroom/bathroom) options selected. For the retail, we are looking to a variety of options including local coffee shops and fitness centers to become prospective retail tenants.

What if there are cost overruns on the development?

We are holding an owner contingency of 8% of the GMP construction contract.

If there are cost overruns, no Member will be required to make any Capital Contributions to the Company other than such Member’s Initial Capital Contribution and, except as set forth below, no Member will be permitted to make any Capital Contributions to the Company other than such Member’s Initial Capital Contribution.

In the event that the Manager determines that additional cash Capital Contributions are necessary or appropriate to pay any operating, capital, or other expenses relating to the Company’s business (such additional Capital Contributions, “Additional Capital Contributions”), the Manager will deliver to all of the Members a written notice (an “Additional Capital Call Notice”) specifying in reasonable detail (i) the aggregate amount of such Additional Capital Contributions, (ii) the purpose for such Additional Capital Contributions, (iii) each Member’s pro rata share of the aggregate amount of such Additional Capital Contributions (based upon each Member’s Membership Interests), and (iv) the date (which date shall not be less than ten (10) Business Days following the date that such Additional Capital Call Notice is given) on which such Additional Capital Contributions shall be required to be made by the Participating Members (as defined below).

Each Member will have five (5) business days following the date that an Additional Capital Call Notice is delivered (such period, the “Election Period”) to notify the Manager in writing whether such Member will fund such Member’s pro rata share of the aggregate amount of Additional Capital Contributions requested pursuant to the Additional Capital Call Notice. Any Member that fails to deliver such a written notice within the Election Period will be deemed to have elected not to fund such Member’s pro rata share of the aggregate amount of Additional Capital Contributions. Any Member that elects not to (or is deemed to have elected not to pursuant to the preceding sentence) fund such Member’s pro rata share of the aggregate requested Additional Capital Contributions shall be deemed to be a “Non-Participating Member.”

The Manager, in its capacity as a Member, will participate in any request for Additional Capital Contributions on a pro rata basis with all other Members. In addition, following the Election Period, the Manager may elect, in its sole discretion, to fund all or any portion of the amount of requested Additional Capital Contributions not funded by Non-Participating Members (a “Funding Shortfall”). The Manager may fund all or any portion of any such Funding Shortfall via an Additional Capital Contribution or a loan from the Manager to the Company.

The above FAQ is a summary of certain information regarding the Company and an investment in Interests. This FAQ is not intended to be exhaustive and is qualified in its entirety by reference to the terms of the Company Agreement and, as applicable, the more detailed disclosure included in the Private Placement Memorandum. The Company Agreement, a form of which will be provided to each prospective investor prior to acceptance of their subscription, should be carefully reviewed by any prospective investor prior to making an investment decision. To the extent that the terms set forth above are inconsistent with those of the Company Agreement or any other document, the Company Agreement or such other document will control.

An investment in the Company involves a high degree of risk. Investors should carefully consider the Risk Factors set forth in the Private Placement Memorandum in evaluating an investment in the Company, and should consult their own legal, tax and financial advisors with respect thereto.